The 183-day rule sounds simple in theory – spend fewer than 183 days in a country, and you may avoid tax residency. But in reality, tracking this across multiple jurisdictions with manual calendars and spreadsheets is largely unsuited to the way modern professionals actually live and work. The problem is that tax compliance tools are either built for accountants – complex, expensive enterprise systems – or they’re glorified note-taking apps that shift the burden of accuracy entirely onto the user.

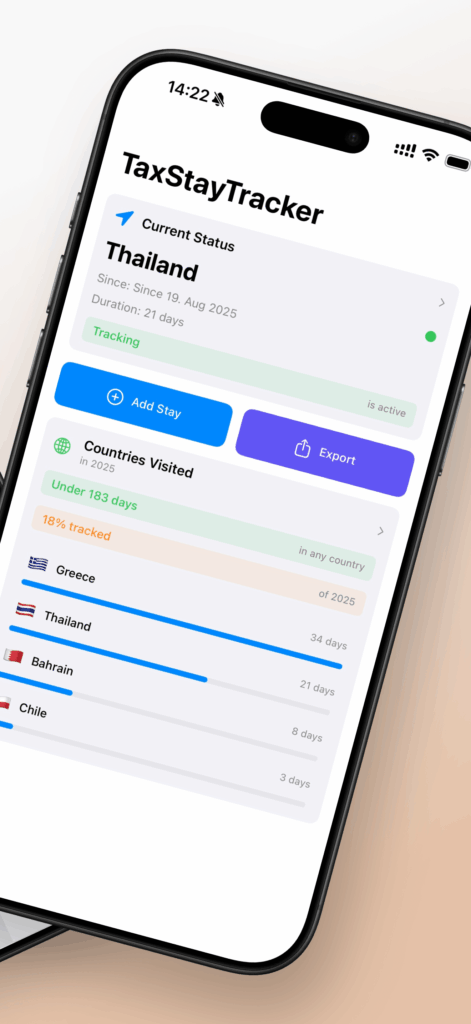

We built TaxStayTracker to solve a salient problem for internationally mobile professionals: accurate, automated location tracking for tax residency purposes, without the overhead of enterprise software or the risk of manual record-keeping.

The Core Challenge

Tax authorities care about one thing – provable presence. “I think I was there for about four months” doesn’t satisfy regulatory requirements. Neither does retroactively trying to reconstruct travel history from boarding passes and credit card statements. What’s needed is a system that tracks presence automatically, handles the complexity of same-day travel and overlapping stays, and produces professional documentation when required.

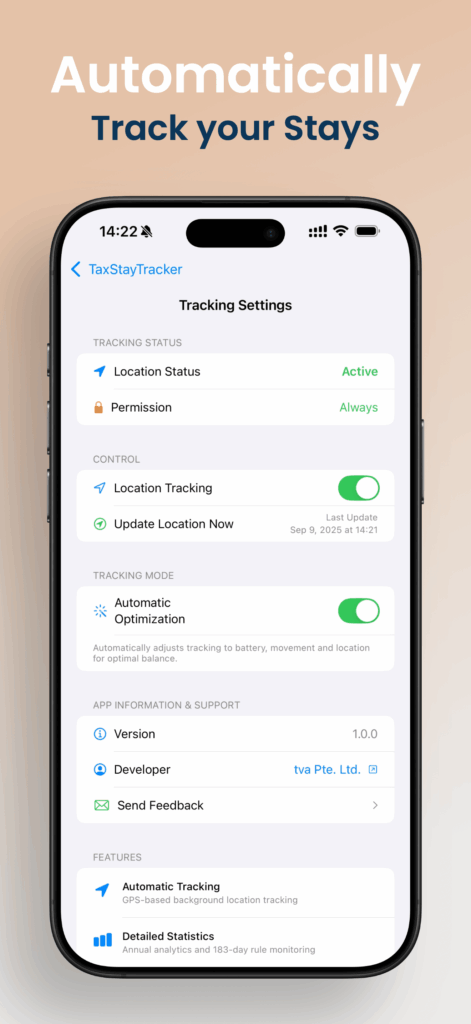

TaxStayTracker approaches this with a carefully designed architecture that separates concerns properly. The app handles automatic GPS tracking with intelligent battery optimization, falling back to offline country detection when network connectivity is limited. Background tracking adapts to battery level and Low Power Mode, using a hybrid strategy of significant location changes and regular updates with intervals ranging from one hour to 24 hours depending on conditions.

The distinction matters. Most location tracking implementations either drain battery aggressively or miss critical data points. TaxStayTracker uses region monitoring for known locations, exponential backoff for failed geocoding attempts, and persistent caching to minimize both battery impact and data usage. This isn’t revolutionary technology – it’s the application of well-understood iOS frameworks in clever ways that prioritize reliability over features.

Manual Entry and Conflict Resolution

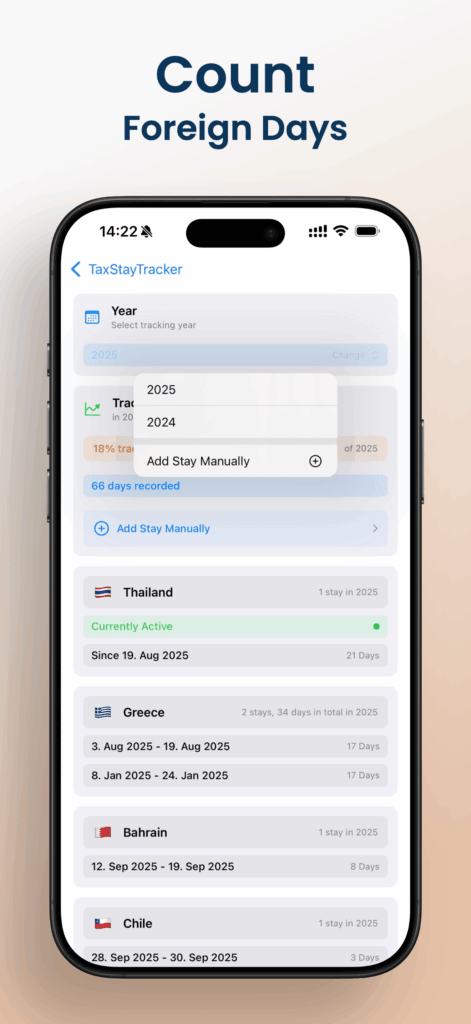

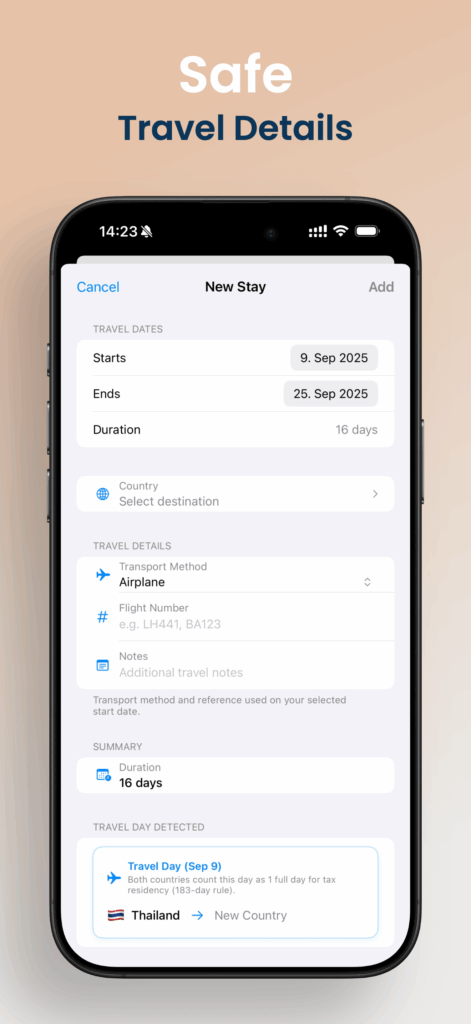

Automatic tracking works well for routine stays, but real-world travel patterns are messy. Same-day business trips, overnight layovers, and retrospective data entry all create edge cases that most systems handle poorly or not at all.

The manual entry system supports retrospective stay entry with intelligent conflict detection. When a new entry overlaps with existing data, the system offers resolution strategies – trim existing stays, split them into multiple entries, or replace them entirely. Same-day travel is explicitly supported, recognizing that tax residency rules often count partial days differently than overnight stays.

This approach acknowledges a fundamental reality: no automatic system captures every scenario perfectly. The question is whether the system degrades gracefully when manual intervention is required, or whether it forces users into workarounds that compromise data integrity.

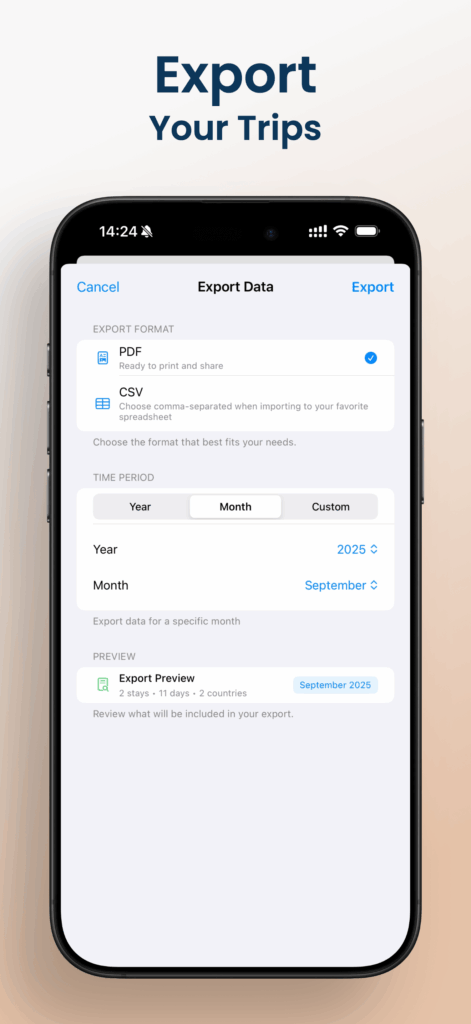

Export and Documentation

Tax compliance ultimately requires documentation. TaxStayTracker generates professional PDF reports following Apple Design Guidelines and CSV exports for spreadsheet applications. Export functionality covers flexible time periods – full years, specific months, or custom date ranges – with statistics and summaries suitable for tax advisors.

The PDF generator produces reports that look like professional documentation, not app screenshots. Country groupings show total days calculation, active versus completed stays, and tracking percentages. For jurisdictions with specific reporting requirements, the CSV export provides raw data that can be further processed or imported into other systems.

Privacy and Data Control

Location tracking for tax purposes creates obvious privacy concerns. TaxStayTracker stores all data locally using Core Data with encryption. There’s no cloud sync, no third-party tracking, and no data transmission beyond the geocoding required to determine country boundaries. Users maintain complete control through data export and deletion capabilities.

This is deliberate. Many location tracking apps monetize user data or require cloud storage with associated privacy trade-offs. For tax-related tracking, the sensitivity of the data demands a privacy-first architecture, even if that means sacrificing features like cross-device sync.

Production-Ready Mobile Development

TaxStayTracker represents the kind of specialized mobile development we do at tva – applications that handle real-world complexity without pretending it doesn’t exist. The architecture uses MVVM with ObservableObject services, NSFetchedResultsController for efficient data queries, and background contexts for heavy operations. It’s not the kind of project that translates well to templates or rapid prototyping tools.

The app demonstrates several technical considerations that matter for production applications: handling Core Data conflicts intelligently, managing background tasks reliably, implementing adaptive caching strategies, and building conflict resolution that users can actually understand. These aren’t features that show up in demo videos, but they’re what determines whether an app works reliably after six months of real-world use.

If you’re considering custom mobile development for specialized use cases – whether tax compliance, field data collection, or any scenario where reliability and data integrity matter more than flashy features – we’d be interested in talking. tva specializes in building production-ready applications that handle the messy details most development shops prefer to avoid.

TaxStayTracker is available for iOS and reflects our approach to software development: solve real problems with carefully designed systems, acknowledge complexity rather than oversimplifying it, and build tools that work reliably when accuracy actually matters. You can download and use it for free in the Apple App Store.